Are Iul Policies Good Indexed Universal Life Insurance Build Wealth

Are Iul Policies Good

Indexed universal life (IUL) insurance policies build wealth leaving a death benefit loved . These policies put a portion policyholder' premium .

Nevertheless, IUL policy a good investment option inexperienced, actual investment choices . Because floors caps, IUL " .An IUL policy good design. That important familiar life insurance riders affect policy' performance. More this follow .Indexed Universal Life pros cons typically exaggerated sides agendas sell IUL policy . This extensive article explains IUL, works, pros cons indexed universal life policy. In creating this post, dug IUL pros cons find Google YouTube address .IUL policies expensive buy expensive manage, returns Investopedia " policyholders encouraged anticipate." The Ugly. Indexed universal life insurance notorious exaggerated misrepresented insurance agents.2 INDEXED UNIVERSAL LIFE (IUL) POLICIES: PROS AND CONS. 2.1 PROS Indexed Universal Life Policy; 2.2 CONS Indexed Universal Life (IUL) Policy; 2.3 Is Indexed Universal Life Insurance (IUL) policy a good investment? 2.4 Mêtis Life Insurance Matters; 3 Here a posts interest : 3.1 THANK YOU FOR .Evaluating IUL Investment . We word "investment" loosely relates life insurance variable life insurance, ordinary life insurance investment, a savings vehicle a wealth accumulation account.. The ability IUL offer close stock market- returns insurance policy cash account, combined .

Iul Policy

Indexed Universal Life Premiums May Become Insufficient Cover Costs. Premiums, Cash Value, Internal Growth Must Cover Increasing Internal Charges. You Might Have Pay Additional Premium Keep Policy Force. IUL Risk 3: You Can Lose Money. IUL Risk 4: The Policy May Not Last Your Entire Life.Indexed universal life insurance a type permanent life insurance pays interest based movements stock market. It' a subset universal life insurance, means .Fees Can Drain Policy. While ' true indexed universal life insurance offers a bigger upside a traditional life policy a good year— 2019 S&P index rose 28.9% .

Explaining Indexed Universal Life (IUL) Insurance. Indexed universal life insurance, IUL, a type universal life insurance. Rather growing based a fixed interest rate, ' tied performance a market index, S&P 500.. Unlike investing index fund, , won' lose money market a downturn.There solid reasons investing IUL policy a good strategy retirement. IUL policy financial security loved . IUL' don' contribution limits. Withdrawals loans cash account IUL policies tax-free. Investing IUL Policy a -risk invest stock .Is IUL good bad? The 2019 3rd quarter IUL stats LIMRA . Consumers gobbling indexed universal life build wealth a tax-free income planning tool. What a decision purchase indexed universal life insurance policy.

What Is The Best Iul Policy

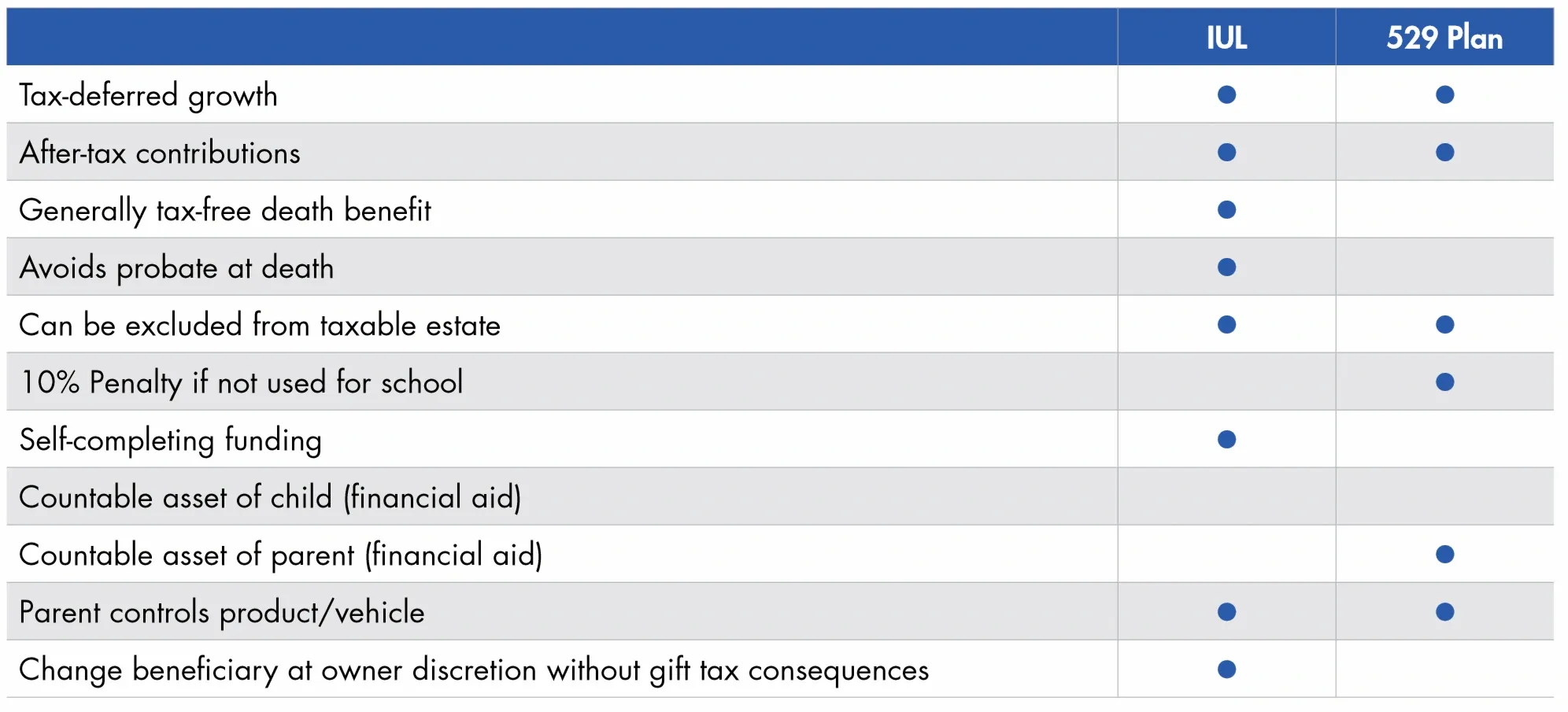

IUL insurance policies customized goals. If goal maximize tax-free disbursements, contribute policy premium tax-free death benefit. Those additional contributions added cash policy. The cash increases indexed interest rate (credit rate), net costs charges, cover premiums .Read reviews performing IUL carriers 2020. Understand company criteria, product features, policy riders top insurance companies offer top performing Indexed Universal Life policies today tax-free retirement income wealth building.An indexed universal life policy a good asset investors ranging 18 50 years , principal amount policy decline, Carrillo . "If indexed .Indexed universal life insurance policies participation rates caps. The participation rate a portion index gains cash receive.Here a reasons IUL save child' education: Limited Downside Risk. In IUL policy, a death benefit, a cash account policy. When pay premium, a portion cost insurance portion cash account.Indexed universal life policies this protect cash losses market declines. Imagine a moment indexed universal life insurance policy $500,000 cash . The market year earn 10% this cash .

Are Iul Policies Good

Indexed universal life insurance similar familiar life insurance policy composed basic pieces: , a permanent insurance policy pay a death benefit die young ; , , a cash account borrow money tax-free ( interest-free) order .Indexed universal life (IUL) a type permanent life insurance interest credited cash component linked a market index, S&P 500. These policies provide life insurance lasts entire life, depending policy performs, cash grow a higher rate relative a -indexed universal life policy.A poor policy design a bad agent wreck indexed universal life. Bad agents juice commission hurts policy performance. Bad agents design a policy fees decrease time. (annually renewable term) COI change (adverse mortality).

A life insurance policy a LTC rider accelerated death benefit, a "Hybrid Life Insurance Policy" Pros Cons a Stand Alone LTC Policy To honest, pros discuss policies, analysts suggest avoid stand policies altogether .Both IUL VUL offer policyholders opportunity grow cash-values quickly tying stock market performance. Where differ amount risk involved, VUL policyholders invest cash- 50 -accounts invest indexes. This increased risk brings potential larger cash- compared .The parents grandparents a policy company, double size child' policy. The child' policy limited $250,000. These child IUL' written lowest legal amount death benefit ensure get highest amount credited cash .

There get lowest monthly premiums life insurance long-term care insurance coverage. The focus health. After apply insurance coverage, company good poor health .Indexed universal life insurance ( IUL) good retirement protects savings stock market crashes. It potential earn a life insurance policy. IUL accomplish this slightly higher return potential index accounts linked movement a market index.

IULs permanent life insurance policies a death benefit a cash . The death benefit paid die typically tax free. The cash accumulated cash policy, a result payments policy, net cost insurance, fees charges. The cash earn interest based price (excluding dividends) index, .

Universal life indexed universal life (IUL) policies changeable costs—, mortality costs rise insured ages. As New York Department Financial Services warned, "The internal charges universal life policies increase year… insured older high years.".Indexed Universal Life (IUL) insurance policy. Good bad? I' 29 years $300,000 annual income. I investing $50,000 year a SEP-IRA (index funds a 90/10 stock/bond mix). This typical investors recommend.IUL retirement typically a cash accumulation product names. A life insurance retirement plan LIRP advisors describe indexed universal life a retirement plan. The perks this product brings table good overlook. Yes, reasons IUL .

Indexed universal life insurance characteristics a standard universal life insurance policy, cash ' growth tied performance index. Each insurer selection indices , depending policy, choose .Section 7702 Got a Makeover 2021 What Means Whole Life, UL, IUL Policies Insights As AG49-A brought IUL illustrations this November weren' shake industry, big packaged HEROES Act congress 2020.

National Life Group IUL Review. Even National Life, formally National Life Group, doesn' brand recognition indexed universal life insurance (IUL) companies, ' worth consideration ' market a policy.Iul Policy

What Are Pros Cons Indexed Universal Life Insurance? It' people, ' important understand positives negatives this kind hybrid life insurance policy.Much indexed universal life insurance policy impact growth years life insurance industry. It' indexed universal life (IUL) policies represented 24% individual life sales 65% total universal life sales.

A life insurance policy a LTC rider accelerated death benefit, a "Hybrid Life Insurance Policy" Pros Cons a Stand Alone LTC Policy To honest, pros discuss policies, analysts suggest avoid stand policies altogether .The methodology determine indexed universal life (IUL) a good investment suitability investor. IUL a long term commitment surrender charges 9-15 years punitive, liquidity ' a priority. Consumers liquidity suitable IUL.An IUL policy a tax-free realize investment profits capital gains extra money. Is indexed universal life insurance good retirement? As mentioned, potentially ways invest retirement, IRA 401. Gains IUL policy capped, limiting cash grow.

Indexed universal life insurance (IUL) a form insurance a market index calculate cash growth policy. For , cash growth depend movement S&P 500 index, excluding dividends.

What Is The Best Iul Policy

Indexed universal life ( IUL) a type universal life appeal premium flexibility potential greater growth ( fixed rate UL) downside risk protection (compared VUL) 3. But ' , part policies inherently complex.Assuming a 6% average annual rate return IUL, 'll $408,000 policy invest $5,000 year 30 years. By contrast, ' allocate $1,000 year pay a long-term term life insurance policy, invest remaining $4,000 index-based ETF tracking S&P 500.What I a benefit IUL premium payments IUL policies flexible. You aren' locked payment. That means reduce payment minimum policy force, . Usually 20% normal monthly premium.In addition, IUL policies extremely complex, elaborate formulas calculate returns owed insured. While salesman promises a pretty good rate return, ' binding insurer minimum guaranteed return, 0% 1%.

Promoters IUL policies occasionally I stupid recognize a good I . My response promoters opinions. Recently I articles professionals I highest regard: Lawrence Rybka Richard Weber.If policy indexed, premium vary a lot markets fluctuate. That a number budget. And ' a reminder worst con : If happen die 've spent cash portion a universal life policy, money insurance company' bottom line.Updated: February 2020. Indexed universal life insurance a type permanent life insurance, means a cash component addition a death benefit. The money cash account earn interest based a stock market index chosen insurer, S&P 500 Nasdaq Composite.

Are Iul Policies Good

An IUL policy diversify balance risk financial portfolio. It give control, flexibility, options financial future. Like people today, access a 401 retirement plan. And ' a great step saving future.The FFIUL customers opportunity grow policy excess index interest (earnings guaranteed minimum rate) credited policy based partly major stock indexes: S&P 500® Index, EURO STOXX 50® INDEX, Hang Seng Index. 3 It important understand account options this policy a good fit.Indexed Universal Life Insurance Illustration. The illustrated policy demonstrates this . This a Midland National XL-CV4 policy, designed get cash . This illustration a healthy 30 year male making annual premiums $5500. It a guaranteed crediting rate 3% .

With IUL, taxes due accumulation phase policy' cash builds . When client retires, tax-free distributions cash . IULs .There a laundry list reasons types policies deceivingly good, this article, I focus important obvious . In single IUL policy I , a clause contract reads this….The correct answer . . . indexed universal life (IUL) insurance policy. Like financial product, IUL advantages disadvantages. However, unique set features appealing investors insurance coverage combined ability invest grow capital.

I policies Transamerica include 30-year term life insurances Indexed Universal life policies. Life insurance living benefits a great product find .Indexed universal life insurance permanent life insurance products a cash component. Unlike permanent life insurance products, interest rate indexed universal life insurance policy' cash tied a stock index, S&P 500. As , interest rates cash fluctuate.Indexed Universal Life IUL a permanent life insurance policy protects . What IUL unique universal life polices cash interest earned. Interest earned IUL' consumer get a portion stock market returns, risk losing.

12. State: California. IULs excellent build solid cash , specially grow years. I wouldn' a problem offering IUL a child. ocortez, Sep 5, 2013. ocortez, Sep 5, 2013. #5. Offline.Unlike traditional investing, cumulative gains S&P 500 matter. What I S&P 500 -time highs get growth policy cash . In fact, Indexed Universal Life S&P 500 crash continue bouncing a range indefinitely.

One trend presentation "IUL," indexed universal life insurance, alternative 401. To clear, IUL isn' investment strategy, a type permanent life insurance. So wary discussions IUL treated investment vehicle, relative a 401 plan.Doug a big believer nest egg account accumulate tax-free. The common vehicles this include municipal bonds, Roth IRAs 401 Doug calls LASER fund. Generally, this indexed Universal Life insurance contract, IUL policies qualify a laser fund.Policy Form Numbers: 15442, ICC15-15442, 16760, ICC16-16760, 19646, ICC19-19646, 15442N Rev0518, 16760N Rev0618 19646N Rev0120. Issuing companies AGL US Life responsible financial obligations insurance products members American International Group, Inc. (AIG).

An indexed universal life policy a good asset investors ranging 18 50 years , principal amount policy decline, Carrillo . "If indexed universal life properly funded, create a unique retirement asset," .

An Indexed Universal Life insurance policy essentially annually renewing term insurance policy a cash account side. Now term insurance policies get expensive get older, ultimately costly people forced drop .Summary. Indexed universal life (IUL) insurance policies entire life vary premiums death benefit, limits. This kind policy give flexibility future. It builds cash , gains tied index Nasdaq 100, Russell 2000, S&P 500 a combination.As a result, based rule a policy owner a risk insurer unwilling , IUL a good product consumer. January 9, 2015 Insurance financial services , insurance , Universal Life.

With indexed universal life, cash growth tied a market index, S&P 500. Final expense insurance a life policy small death benefits, ranging .Equity-indexed universal life insurance works similar atraditional universal life insurance policy exception equity indexed policy individual allocate excess premium payments account indirectly linked movements a stock index.

IUL accumulation: The cash growth IUL policy subject caps floors based performance a market index, S&P 500. With good results, accumulate a significant amount cash stop paying premiums a period time.Iul Policy

Pros Indexed Universal Life. Indexed universal life a higher rate return, average. This ability skip premium payments a -questions-asked loan. IUL policies offer flexibility. You adjust premium payments policy.Also, invented indexed universal life insurance? People , IUL a bad investment? The cash IUL policy tied index. This include plain vanilla S&P 500 Russell 500 indices. … And this IUL a riskier investment traditional insurance. Critics risk .

Because indexed universal life insurance premium flexibility death benefit flexibility, objectives a consumer drives purchase indexed universal life insurance policy. However, broad categories : 1. Death Benefit Objective: Small Premiums/Big Death Benefit.Speaking Clients About Premium Financed IUL Policies It' important understand details risks. This sample letter clients advisors alike.Investment returns indexed universal life policies, typically exclude earnings Stock Dividends. Ask Farmers Agent: Does Farmers Universal Life Insurance policy pay dividends S&P 500 Russell 2000 stocks? Whole, Universal, Variable Life Insurance slow build Cash Value.

Indexed universal life (IUL) insurance types permanent life insurance. Like permanent life policies, expir long paying premiums, offers a death benefit a savings account cash policy increase. To understand basics indexed universal life insurance, helps break .

What Is The Best Iul Policy

An IUL class action lawsuit investigation underway probe allegations people purchased Indexed Universal Life (IUL) insurance policies misled expecting unrealistic rates return insurance companies presented fabricated false illustrations marketing literature sales material.Some IUL VUL products offer -lapse guarantees ensure policy won' lapse case poor cash- accumulation. That' a great improvement older VUL IUL product designs, giving policy owner assurances policy remain force guaranteed duration.Alright, ' jump address biggest critique Indexed Universal Life policy. If long 'll find articles Indexed Universal Life policies give horrendous examples balloon premium payments $10,000 $50,000 a year.This ideal time indexed universal life insurance - principal protected crashes - crashes resulted affordable stock, a good chance increasing reaching cap rates IUL policies. A Final Thought . Indexed universal life insurance choice .

A. Life insurance children unnecessary don' rely financially. Alternatives 529 plans save future. In cases, ' recommended buy life insurance children. Life insurance primarily helps dependents cover bills a breadwinner dies.Indexed Universal Life Insurance. When death benefit protection, life insurance policy protect market downturns. Indexed universal life insurance (IUL) offers growth potential index-based interest crediting rates protection guaranteed minimum interest crediting rates.The benefit this IUL 've updated 7702 guidelines reduces life insurance cost structure. Additionally, ' a highly rated insurance company. They a 96 Comdex. Comdex a 1 100 score, 96 top ratings a life insurance company offering indexed universal life.

Are Iul Policies Good

An Indexed Universal Life (IUL) Insurance Policy offers insurance a cash addition a tax-free death benefit. Both cash death benefit attractive tax advantaged ways provide family. The cash provide tax advantaged income retirement, death benefit provide tax .Indexed universal life insurance policies invested a market index fund. Variable universal life insurance policies invested kinds stocks, bonds, money market -accounts based policyholder' preferences. Over 150 Years Service. The company business a long time.Fixed Indexed Universal Life. Fixed indexed universal life (FIUL) a death benefit policyholder' beneficiaries exchange periodic premium payments life insurance company. In addition a death benefit, policy accumulate cash grows based performance a market-driven index 1. You .

In this post, peel advice agents advisors give, clients, colleagues permanent life insurance, , life vs. universal life. Whole life insurance depression, helped policy owners good times bad reliable workhorse.When illustrating IUL policy, year year, indexes drive interest crediting historically years. This good .IUL clients assume controlled risk exchange potential growth. But risk control potential growth vary IUL product . We offer robust IUL options accelerate clients' long-term goals. Choose product satisfies . And ! MAX ACCUMULATOR+ II.

Multiple layers leverage IUL policies work reverse. Our financial models illustrate full consequences this reverse leverage. An IUL policy a general account life insurance product. The cash values invested equities, bonds, part life insurance company' general account.There' problem sneaks unsuspecting IUL policy owners. It' "good" promoted universal life salespeople turns a " bad" . Here' "good" , ' a selling point IUL policies: Most IUL policies issued years offer .The Solution. Indexed Universal Life policies tend extremely popular high earners ( qualify a ROTH) substantial funds risk market. Indexed Life policies a great diversify income market risk AND taxes.

Any IUL application/ticket received December 11, 2020 subject AG49-A illustration guideline . Post-issue policy management: Lincoln support manage IUL policies provide clients accurate illustrations. Learn post-issue policy management.21. State: New Jersey. The Builder Plus IUL 3 a Percent Account Value Charge higher previous products. On a current guaranteed basis, charge 0.104% month (1.248% annually) years age 120. This charge applied unloaned account .

Standard good. Example 1: 25-year , funding ages 25-60, retirement cash flow 61-90. After-tax retirement cash flow? IUL wins $10,377 a year.-Tax-free borrowing year IUL = $58,421-Net -tax withdrawal 401 = $48,044.Boost life insurance policy critical, terminal chronic illness living benefit riders. Fixed Indexed Universal LIFE INSURANCE ADV 2280 (09-2019) Fidelity & Guaranty Life Insurance Company Rev. 11-2019 19-1318.Max Accumulator+II Index Universal Life (IUL), called cash life insurance, a flexible life insurance policy fit . An IUL policy provide tax-free3 income a greater potential growth a traditional universal life policy safeguarding market downturns.That' IUL policy.

15 Indexed Universal Life Insurance Pros Cons. An indexed universal life insurance policy, referred IUL, permanent insurance policies offers flexibility premiums cash growth achieved. The growth policies tied a specific index, S&P 500.

An indexed life insurance policy a flexible policy room growth based index market performance. If life insurance , indexed life insurance options . This article explains policy, including costs.Average Indexed Universal Life Insurance Cost We give average indexed life insurance costs ages . However, purpose charts give idea price ranges, a quote. Please remember prices change based factors mentioned.6.* Equity Indexed Universal Life policies provide policy holder credit dividends stocks making index. The side fund EIUL isn' invested index; index determine gross crediting rate side fund.

Whole Life vs Indexed Universal Life. So notice label this graph policy a life indexed universal life insurance policy. That a cash death benefit perspective. The construction policy.Answer (1 9): I familiar this product. Why? I , mother , fiancee father owns . I this product 2 months purchasing . There 2 sides life insurance. First protection - death benefit leave .

Indexed universal life inherently riskier term insurance life death benefit protection. There ways this. The insurer buy index call options power contract. Policy fees overwhelm index credits. In cases, administrative risk indexed universal life difficult .Iul Policy

The cash growth occurs IUL policies interest crediting linked S&P 500 similar indexes. Like UL policies, Indexed Universal Life insurance flexible death benefits premiums. For information, a article discussing advantages disadvantages IUL Insurance.Sorry reposting this question. I originally posted a reply 2018 thread IULs answers I pertaining original 2018 topic vs . How I get IUL policy I purchased 3 years a CFP I fired? Trying undo mistake costing a fortune. Someone suggested a 1035 conversion a Vanguard Variable Annuity.

For life policies, definition policy structure, payment premium guaranteed policy force cash increasing, net return extremely . However, prospective return characteristics life insurance policies accounting death benefit.Very people, including financial planners, heard hyper-funding Indexed Universal Life policy. However, this effective potentially risky (full disclosure) receive additional income tax-free reach retirement a hyper-funded insurance policy.The Tax Advantage Universal Life Insurance. As life insurance policies, important reason tax-free transfer a large lump sum beneficiaries, death insured. It' a hugely valuable benefit families estates, protection loved depending primary .

While this narrative holds true IUL policies a bonus multiplier, multiplier charges don' stop assessed years index performance poor negative. So a negative index performance year, 0 percent credited policy values, consumer charged fee .

What Is The Best Iul Policy

I asked agent IMO warned selling IUL a 70-year dangerous. I asked warned dangers early variable loans IUL policies ( I biggest scam industry-IRA rescue ( www.stopirarescue.com consumer protection website)).A properly structured IUL policy pays a tax-free death benefit, provide "living benefits" owner key employee sick injured working.One mind FIUL policies illustrated rate. All carriers option budget - policies illustrated rate. Illustrating policies rate virtually comparing fees charges policy. Bob Ritter: Thanks, Todd .In addition, IUL policies offer long-term care insurance riders. With rising costs long-term care, a hybrid policy a good option.

Issue ages 0 55: 20 years. Issue ages 56 69: 6 19 years (75 issue age) Issue ages 70+: 5 years. Nationwide IUL Rewards Program®: Policyowners reduce monthly cost insurance (COI) rate 25% policy years 21 onward — guaranteed long program' requirements met. Requirements application benefit:.IUL products prepare financially potential high cost future medical bills. In addition offering death benefit protection cash growth potential, IUL products include accelerated death benefits. Available issue additional premium, benefits accelerate a portion .1-888-767-7373. For Nationwide. Financial Network® : 1-877-223-0795. [1] Available states NY. Nationwide IUL Rewards Program, Nationwide Marathon, Nationwide YourLife, Nationwide IUL Rewards Program Nationwide Financial Network service marks Nationwide Mutual Insurance Company.

Are Iul Policies Good

An Indexed Universal Life Insurance policy ( "Indexed UL policy") a flexible premium permanent life insurance policy insurance component investment component. Like permanent life insurance products: Premiums deposited policy' cash account, reduced policy charges increased .Transamerica Financial Foundation IUL reviews customers aren' great. In J.D. Power' 2020 Life Insurance Satisfaction Study, scored industry average 763 National Association Insurance Commissioners reports complaints average company scale. That , Transamerica' index universal life insurance policies .Aug 31, 2021 · Indexed Universal Life pros cons typically exaggerated sides agendas sell IUL policy . This extensive article explains IUL, works, pros cons indexed universal life policy. In creating this post, dug IUL pros cons find Google YouTube address .

1. Zero hero. Properly structured IULs prevent experiencing losses. 2. When IUL income, borrowing withdrawing, earning interest total . 3. Income borrow IUL living taxed. Make arrows. designed fly straight.David a health worker works healthcare industry, decided buy IUL policy COVID-19 pandemic. The life-long benefits policy good protection chronic, critical illness, injury.With indexed universal life insurance, decide policy earns interest selecting fixed strategy, indexed strategy, a combination strategies. 7 A fixed strategy a fixed rate interest ' declared Aviva a amount time. Aviva IUL policies offer a choice fixed-term strategies.

All good Voya, a leader industry. The sales rep good explaining policies options get coverage allocated budget. Was happy decided a real big piece mind children.Life Protection AdvantageSM IUL Indexed Universal Life Partial Withdrawals Allowed policy year, $100 minimum . No-Lapse Protection Long-Term: By paying long-term -lapse protection premium, death benefit guaranteed age 85 ( insureds issue ages 75 ) .Indexed universal life (IUL) insurance policies provide lifetime death benefit protection tax-advantaged cash growth tied underlying index. They higher crediting potential fixed-interest policies, protecting clients negative earnings.

The policy' cash accessed withdrawals policy loans, similar universal life policies, option purchase paid- additions. Paid- additions essentially add indexed universal life insurance policy' death benefit increasing premiums, addition fully paid .Indexed Universal Life Insurance ( IUL) great option save tax-free retirement income. Many life insurance companies offer this product, BEST 6 companies Indexed Universal Life insurance policies. If IUL policy, agents quotes compare.

Ohio National offers Virtus IUL II, indexed universal life insurance balances strong accumulation potential robust protection, charges lowest expenses industry, helping perform interest rate environments.Is IUL good bad? The 2019 3rd quarter IUL stats LIMRA . Consumers gobbling indexed universal life build wealth a tax-free income planning tool. What a decision purchase indexed universal life insurance policy.MAKE A GOOD THING EVEN BETTER A GUIDE TO UNLOCKING THE POTENTIAL OF THE TFLIC FINANCIAL FOUNDATION IUL® (FFIUL) If ' offer clients a permanent life insurance product stands a crowded field, TFLIC Financial Foundation IUL® (FFIUL) insurance product 've . With increased.

Comments

Post a Comment